- 05.02.2016

- 2'30 min

- 0

How do french people prepare for their retirement?

Retirement and financing a pension are a major subject of concern among French people. Unlike today’s pensioners financed largely by the general retirement pension system, people in work today are convinced that they need to set some savings aside to top up their pensions. Their preference goes to savings products that offer both security and high yields, and in particular life insurance.

The study conducted in late 2014 within the framework of the Deloitte “Les Français et la Préparation à la Retraite” barometer confirmed that for French people, the amount of their income after they retire is a major concern. Two people in three among the active population state that they are worried about preparing for their retirement. This concern is felt more particularly among the under-45s and those in the least advantaged social and professional categories.

75% of the active population state that they are worried about the amount of their future retirement pension. In addition to this, they also regret a lack of information. 78% of the active population have no more than a vague idea, at best, of the amount of their future pension, and only 3 in 10 feel sufficiently informed about their pension entitlement and future financial needs.

75% of the active population state that they are worried about the amount of their future retirement pension.

One sign of the prevalence of this concern is that French people are beginning to prepare for their retirement at an increasingly young age. They start preparing, on average, at the age of 45, some 20 years before their estimated retirement date, allowing them twice as long to prepare than today’s retirees.

The French aware of the need to save for their retirement

Almost 8 people in 10 among the active population consider that they will need to top up their pension with some additional income. They estimate that their pension will be slightly over half of their level of income at the end of their career, when they are going to need a pension that is equivalent to 77% of their income at retirement age if they are to cover their daily expenditure.

A logical consequence of this is that 54% of the active population put money aside to provide sufficient income once they retire. This proportion increases significantly with age and for higher income levels. It should be noted, however, that the proportion of workers under the age of 45 who declare that they are already preparing for their retirement has increased significantly in recent years. Today, 41% of 25-34 year-olds are already putting money to one side to finance their retirement.

The average sum saved each year to prepare for retirement is €1,688, although this average figure does hide great disparities according to income: for 72% of savers, the average amount saved stands at €452, against €4,736 for the 28% highest earners.

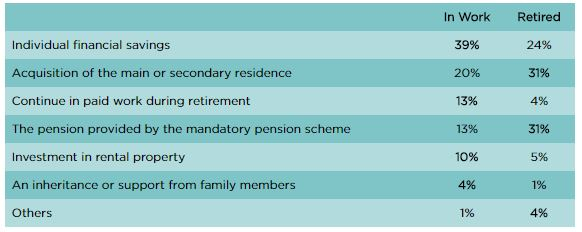

Differing preparation strategies from one generation to another

To offset the drop in their income once they retire, today’s retired people turned to two main levers: buying their main or secondary residence and their pension from the mandatory general pension scheme.

Today’s workers, meanwhile, are focusing primarily on individual savings.

The main levers to ensure a satisfactory income level on retirement:

Source: Deloitte “Les Français et la Préparation de la Retraite” Barometer (4thed.).

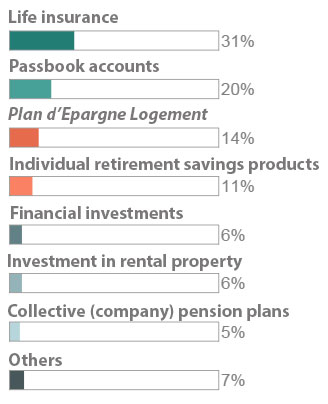

As regards the criteria for choosing a pension savings product, the “security and yields” combination is the overwhelming preference among working people preparing for their retirement, followed by the availability of the capital and taxation terms. The ancillary guarantees (personal risk cover, personal services, etc.) are less decisive when choosing an investment.

To increase their retirement income levels, working people choose several types of investments: life insurance leads the way, followed by passbook accounts and the Plan d’Epargne Logement.

Life insurance has progressed strongly since 2012 (+10 points), unlike passbook accounts (down 15 points since 2012), in particular due to the fall in the interest rates they offer.

Of the working people who have made financial provision for their retirement, 43% have taken out a life insurance policy, 31% have opted for financial products, 23% for employee savings schemes (PEE, PERCO) and 22% for retirement savings schemes (PERP, Madelin schemes, Article 83 schemes) (situation at end 2015 - UFF/IFOP Barometer).

There are three priority criteria when making the choice of retirement savings products: the security of the investment (for 72% of workers), investment yields (for 59%) and how easy it is to withdraw all or part of the invested capital (for 53%).

Preferred investments among working people to provide for their retirement:

Source: Deloitte “Les Français et la Préparation de la Retraite” Barometer (4thed.).

Support needed to put together a savings strategy

Over half of the working people who are preparing for their retirement feel the need to be supported in putting together their savings strategy. Only 34% have a clear understanding of the market and the products on offer.

In today’s innovation-friendly context, over two-thirds of working people are interested in new digital systems to help prepare for their retirement (financial advice, daily financial management applications, etc.) and 16% would be ready to pay for such services.

Article sources: Deloitte “Les Français et la Préparation de la Retraite” Barometer (4th ed.). The data come from a survey conducted in autumn 2014.